FICO Credit Scoring

What is FICO? The Fair Isaac Corporation (FICO) scoring model was developed in 1989 and is the most widely used scoring model in lending decisions in America. FICO scores and the effects that different transactions have on your credit scores can vary widely. These transactions include charge-offs, collections, mortgage modifications, mortgage refinancing, loan modifications, student loans, bankruptcies, foreclosures, deeds-in-lieu, and short sales. Lenders request 27 million FICO scores a day (10 billion a year) to make their credit decisions. Where does your FICO score fall in the following breakdown?

800-850 - These FICO Scores are considered EXCELLENT

740-799 - These FICO Scores are considered VERY GOOD

670-739 - These FICO Scores are considered AVERAGE

580-669 - These FICO Scores are considered FAIR/POOR

300-579 - These FICO Scores are considered VERY POOR/BAD

The classic FICO scores used today by the vast majority of lenders fall within the 300-850 score range. Not to be confusing, but there are alternative versions of FICO scores—the FICO Industry Scores—which range between 250 and 900. Some lenders use the FICO Score NG, which falls within a 150-950 range. In simple terms, higher FICO scores are considered lower risk (GOOD), while lower FICO scores are considered higher risk (BAD). Therefore, where you fit into these scores determines if you will be approved for a loan and, if approved, what interest rate you will pay!

In fact, a U.S. News and World Report article stated that "the FICO score is the No. 1 piece of data to determine how much you'll pay on a loan and whether you'll even get credit." FICO scores are used by thousands of creditors, including the 50 largest lenders, making it the most widely used credit score. Experts estimate that:

• FICO Scores are used in 90% of lending decisions.

• FICO Scores are used today in more than 20 countries on 5 continents.

• FICO Scores are used by the top 50 U.S. Financial Institutions.

• FICO Scores are used by the 25 largest U.S. credit card issuers.

• FICO Scores are used by the 25 largest U.S. auto lenders.

So, it's safe to say that FICO Scores are very important!

How are my FICO Scores calculated?

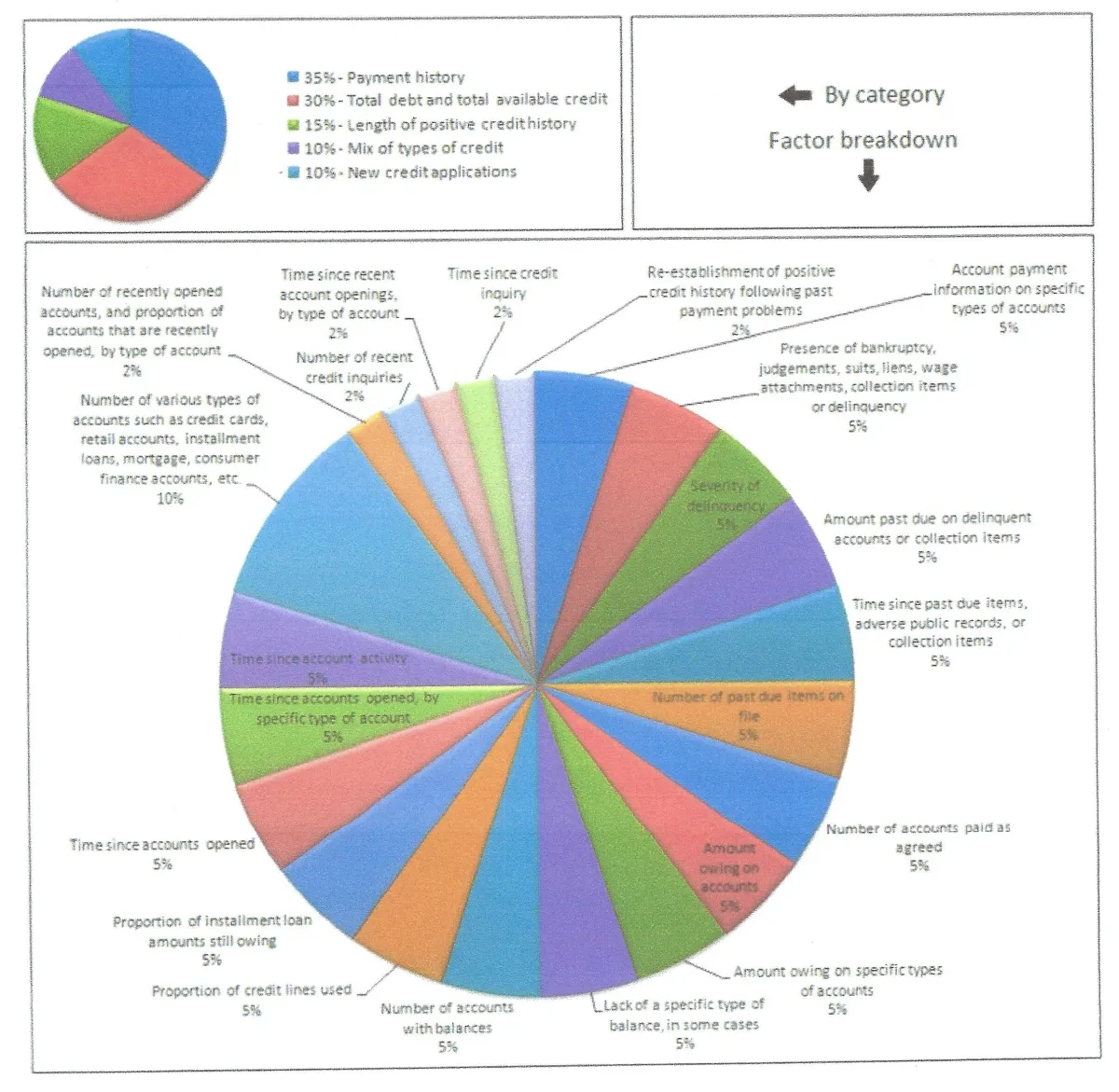

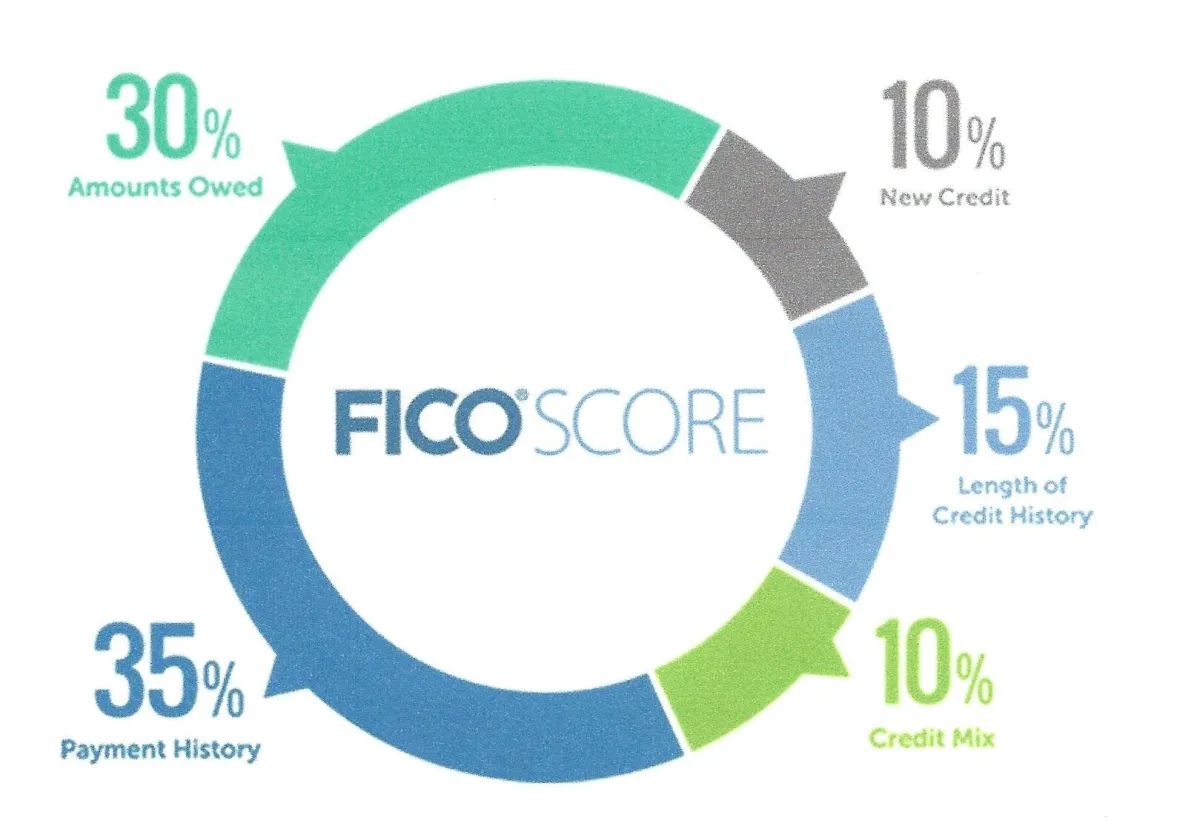

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: Payment History (35%), Amounts Owed (30%), Length Of Credit History (15%), New Credit (10%), and Credit Mix (10%).

The percentages in the chart reflect the importance of each category in determining how your FICO scores are calculated. These percentages are based on the relevance of the five categories for the general population. The significance of these five categories may vary from person to person, depending on the factor breakdown that can be seen in the detailed pie chart attached, titled “What's in Your Credit Score.”

Your FICO scores consider both positive and negative information in your credit report. As you can see, payment history is the most important factor in your FICO scores. Late payments will lower your FICO scores, but establishing or reestablishing a good track record of making payments on time will raise your credit score. Payment history makes up 35% of your FICO credit scores, followed very closely by how well you manage your credit utilization, which accounts for 30%.

What's In Your Credit Score?